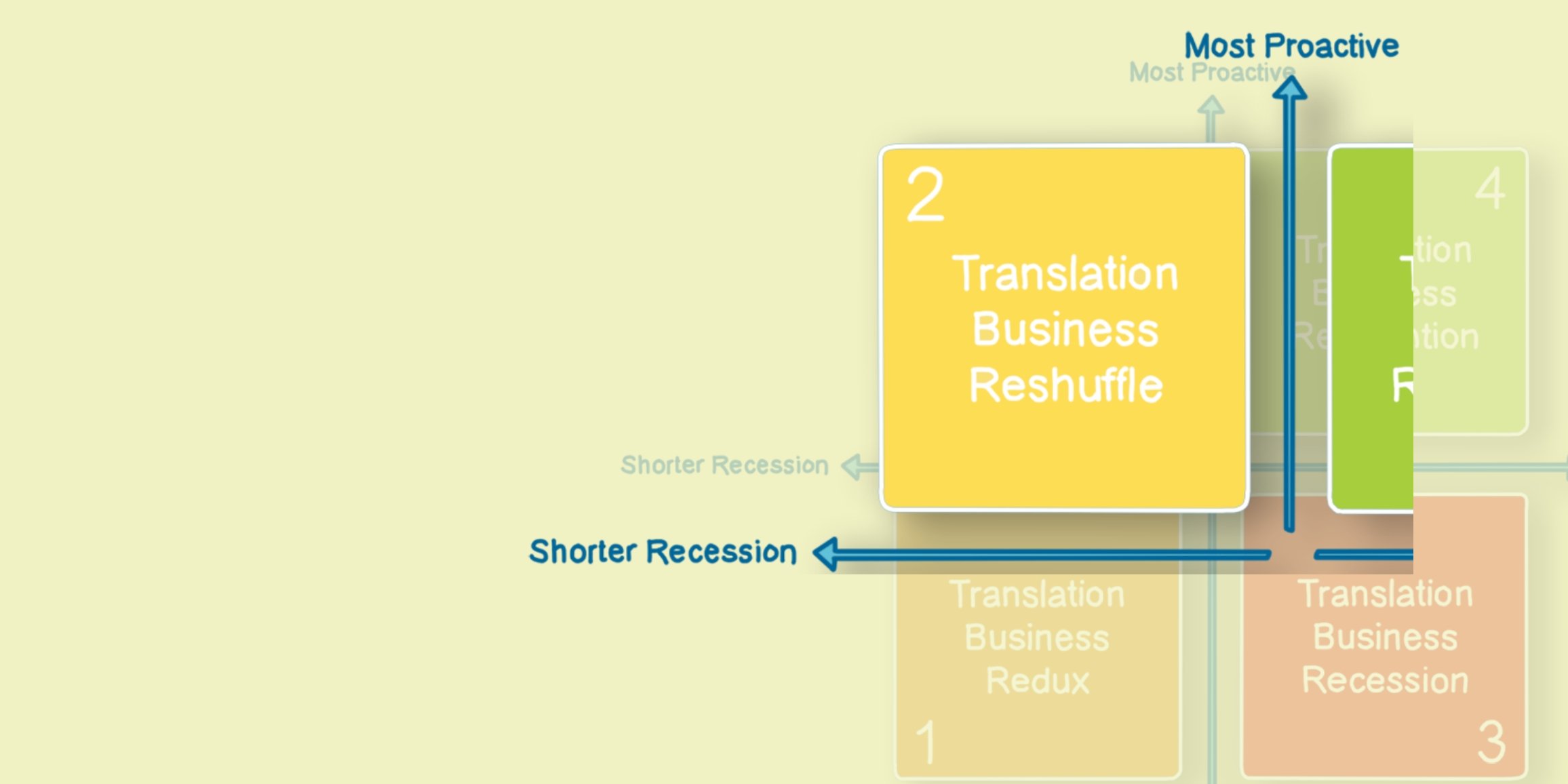

Translation Business Reshuffle

07/05/2020

Two hundred people responded to our survey about the state of the translation industry in the summer of 2021. In this series, we will sequentially analyze each post-corona scenario: Redux, Reshuffle, Recession, Reinvention.

Author

Jaap van der Meer founded TAUS in 2004. He is a language industry pioneer and visionary, who started his first translation company, INK, in The Netherlands in 1980. Jaap is a regular speaker at conferences and author of many articles about technologies, translation and globalization trends.

Related Articles

03/06/2025

Discover how AI and innovation are transforming the localization industry and challenging traditional methods.

21/11/2024

Celebrating the 20th anniversary of TAUS this month caused the team to look back at the predictions and outcomes so far. What have we achieved? What went wrong?

by Dace Dzeguze

by Dace Dzeguze27/11/2023

Explore the fascinating journey of Lisa Vasileva, a Machine Learning Engineer at TAUS, as she transitions from a professional translator to the field of Natural Language Processing (NLP).